I’ve been writing about personal finance for more than six years now. In that time I’ve amassed a lot of know-how on good (and bad) ways to manage money. But those years have made me even better at a more crucial skill: writing about money with authority. I’m literally paid to sound like I (and the sites I write for) have the answers to every money problem.

My professional writing is on point, and I make sure it is. Because I have editors and fact checkers who will kick me in the ovaries if it isn’t, and also my job depends on it.

In the realm of my own money, however, things get a bit…murkier. Messier. Uglier. Because hey, I’m human, and living proof that knowing better isn’t always the same as doing better.

Case in point: going way over budget just halfway through January. Here’s how I blew my monthly budget in just 15 days, and what I plan to do to fix it.

Building my full-time-to-freelance budget…

I did this terrifying thing recently of quitting my job to freelance and work on Brave Saver full time. (And also buy back some sanity and get my shit back in balance, but that’s beside the point.)

Before taking this plunge, I went over my finances with a fine-tooth comb. I reviewed three-plus months’ worth of expenses in granular detail. Then I worked up a budget that was pretty conservative, a bit barebones, but which seemed realistic nonetheless.

Best of all, it scaled our expenses back to less than my husband’s take-home pay, with a buffer of about $300 each month. This was important, as it meant we could make do without my income and be just fine. Anything I made would just be gravy on top. Those funds could be used for nice-to-have stuff like extra payments on our car loan, getting ahead (more catching up, really) on retirement savings, or paying for family outings or travel.

Then going over budget in month one

That was the plan, but boy I was not prepared to execute. Setting up my new budget made me feel secure. But I didn’t follow through with the correlating behavior changes to make it happen.

I made some minimal efforts, sure. I started

About January 15 I decided to do a full tally of all our spending for the month. I added everything up and… oof, ouch, MY BONES. We only had $360 left to spend for the month. But then I checked again and realized there were a couple of outstanding expenses we had yet to pay. So actually, we were already on track to go well over budget — by close to $500.

Here’s exactly what took my spending plan down

After reviewing our spending and comparing it to our targets for each category, I identified our “problem purchases.” Here are the expenses that really blew the budget out of the water:

- $150 membership to the local children’s

discover center, justified by the “need” to have somewhere to take my kids where they can run around and get out some energy during the cold winter months - $210 on asthma and allergy medication, resulting from my husband’s and son’s December trip to an allergist

- $160 more on two HEPA filters and hypoallergenic mattress covers (from Target)

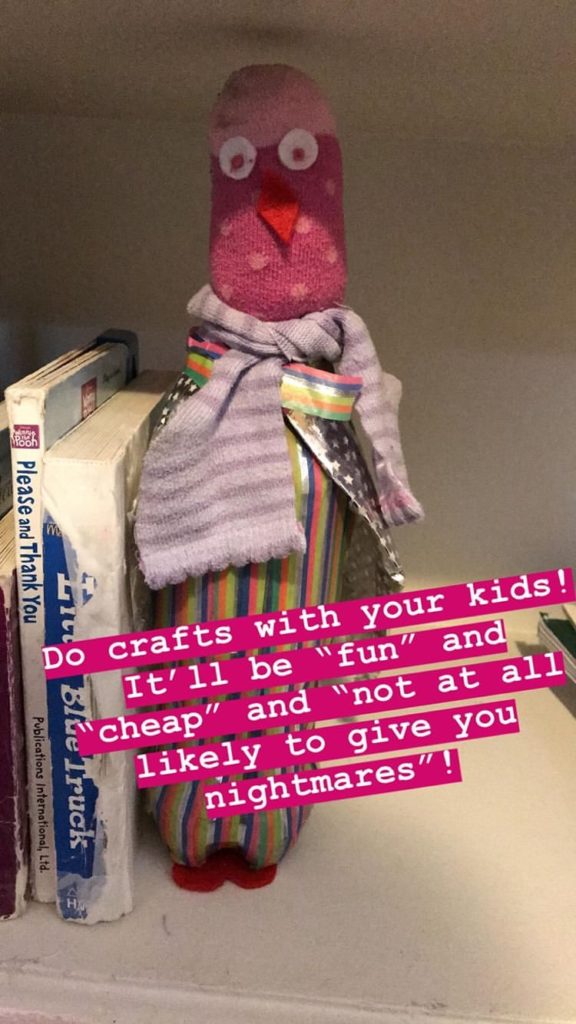

- Another $160 of garbage I bought at Target because I made the mistake of walking through the store after picking up my online-ordered filters and mattress covers, because I wanted to do some stupid craft with my daughter, and also because I am a weak shell of a human

Some of the above are legitimate needs and investments in family members’ health. Others are justifiable but honestly, aren’t necessities. That last one is simply a testament to the hypnotizing powers of Target to make you forget the words “budget” and “spending limit.” And besides the health-related purchases, none of these purchases were worth blowing my budget.

The takeaway I gleaned from the above is that I got very used to living off of our two incomes and the spending wiggle room it afforded us.

But when things tightened up I made only cursory efforts to adapt.

My budget code blue: How I’m handling this cash-flow crisis

While my budget has already been blown, the month’s not over yet. I still have time to make up for my spending missteps and find a way to come out ahead for the month.

Here’s what I plan to do to keep January from becoming a total wash.

Freeze spending on non-necessities

Basically, if it’s not completely necessary to keep us alive, healthy, and employed, it’s not gettin’ bought. It can wait until next month.

Minimize spending on necessities

There are still two weeks left in the month, and there are still costs we’ll need to cover such as groceries, gas, and child care.

I’ll spend on those necessities, but even there I’m going to cut back. I’ll walk instead of drive when possible, raid my pantry before heading to the grocery store, and even skip my beloved $5 grocery pickup service.

Make some returns

For Christmas, my husband got me a pair of shoes from a brand I love (Rothy’s), but in a style I wasn’t crazy about. I shipped them back, intending to pick out a replacement pair.

But now, I’m going to just take the cash and run, and just view this as my switching out shoes for my new Christmas gift of whatever junk I bought at Target (Washi tape? Puffy paint? A bright yellow umbrella covered in flamingos? Why did I think I needed these things??).

I also have a couple of tops I’ve been meaning to return since before the holidays. That will be a top priority over the weekend, too, and should help me get back about $40.

Take on more work

I was trying to keep my freelance schedule fairly open, giving myself more time to chase after the right clients and take care of ramp-up tasks such as building a portfolio site and writing up pitches. But now that I’m seeing my spending in action, I have a bit more urgency to get the work coming in hotter and heavier than I planned.

I’ve already messaged my clients and asked for more assignments in the

Switch to cash-only

I thought that I was clever tracking all my expenses on paper. And while it did make me more aware of my spending, I realize this strategy has a fatal flaw. The pain of writing down my purchases comes after the fact, so it’s less effective for preventing overspending.

For the rest of January and February, I’m going to try switching to cash-only for all spending categories. Parting with cash is more psychologically painful than swiping a card while making it impossible to overspend (once the cash is gone, it’s gone!).

Ban myself from stores

The real lesson here is that Target is a black hole of will and self-control and I really can’t be held responsible for what happens once I’ve passed those red sliding glass doors.

But, I can hold myself responsible for whether I ever go there in the first place. Hence the rule that I’m not allowed to set foot (digitally or physically) in a Target, Costco, or Amazon in January or February.

If we truly need to buy something, I’ll have to send my husband in. He’s less suggestible to marketing than me in general, and specifically immune to the siren song of faux-midcentury-modern home decor and the parenting fantasy (lies!) of wholesome, harmless fun with children promised by craft supplies. And I can always rely on him to underspend by doing me the “favor” of forgetting to pick up at least one thing on the shopping list.

All of this is my way of saying: even personal finance experts make mistakes! (Especially the real sloppy ones, like

But my money expertise has lent me the wisdom of knowing that no one expense or month’s budget will make or break my finances. And if you make a mistake, you can look for ways to make up for it elsewhere.

So if you, like me, already blew your monthly budget, see if you can follow the steps I’m taking to get back on track or forge your own path to spend and budget smarter in February and throughout 2019.

Featured image courtesy Jacob Mejicanos via Unplash

10 Comments

When Financial "Tough Love" Turns to Toxic Money Shame- Brave Saver

January 25, 2019 at 9:28 pm[…] I’m less likely to spiral into feeling worthless and depressed when I make a poor choice or blow my budget. Instead, I can take a balanced look at what went wrong and make a plan for how to move […]

The Shutdown Shows Why Civic Engagement Must Be Part of Your Financial Plan - Brave Saver

January 29, 2019 at 7:44 pm[…] own. The policies in place in our country dictate whether your health insurance is affordable or breaks your budget. These policies determine who pays taxes, and how much, and how these contributions are used to […]

There’s No “Right Choice”: Choose What You Want, and Then Make It Right - Brave Saver

March 4, 2019 at 9:42 pm[…] feel guilty about having to tighten the family budget, and even more guilty whenever I fail to stick to our budget or have to spend […]

Parents of Young Kids: It’s Perfectly Fine to Put Off College Savings - Brave Saver

May 22, 2019 at 5:37 am[…] we have a lot more room in our budget now for “nice-to-haves,” such as saving for college. So we decided it was finally the right […]

Mad Money: How the Wrong Financial Advice Can Drive You Crazy - Brave Saver

June 10, 2019 at 12:44 am[…] you falter or run into a new hardship, remember to stay on your own side. Give yourself room to fail a little while figuring out which financial methods work for […]

I Drive a Beater — But Don’t Ask Me to Love It - Brave Saver

July 24, 2019 at 4:00 pm[…] exactly dying to upgrade my hair, my wardrobe, or my car — I just craved having the same space in my budget to do so if I […]

Save Money on School Lunches: 11 Tips for Busy Parents - Brave Saver

August 14, 2019 at 6:14 am[…] But I’m not excited for every part of the back-to-school routine, however. One persistent pain in my budget is figuring out how to save money on school […]

Build Self-Awareness for Effective Money Management | Brave Saver

September 10, 2019 at 8:35 pm[…] Nope. Simply making a plan won’t lead to the outcomes I want. (Just ask my January spending, which imploded my monthly budget.) […]

Budgeting Isn’t Saying “No” — It's Saying “Yes” When It Matters - Brave Saver

September 28, 2019 at 4:25 am[…] going to spending I wish I was doing, soon or later the wish would turn to an impulse buy. I’d blow my budget over something […]

You're the One Your Money Has Been Waiting For - Brave Saver

December 5, 2019 at 5:19 pm[…] I daydreamed that some Actual Adult™ would show up and give me the answers. Tell me who I am and what I’m meant to do with my life. Help me make all the right choices. Clean up my messes, solve my problems. Stop overspending, do better at work, and stop blowing my budget. […]